Rental tax depreciation calculator

How to calculate the amount of foreign dividends on. If you didnt claim all the depreciation you were entitled to deduct you must still reduce your basis in the property by the full amount of depreciation that you could have deducted.

How To Calculate Depreciation On Rental Property

Tax Depreciation Is SO Important.

. I understand that as donor my mother needs to file form 709 and pays zero tax because of the 545M gift limit. The premise is the same as gross rental yield but this time we will subtract out expenses in order to get a truer metric for comparison. You didnt claim depreciation in prior years on a depreciable asset.

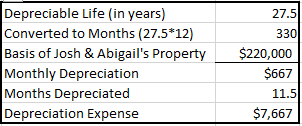

Depreciation commences as soon as the property is placed in service or available. Here are the facts. The expenses can include taxes insurance repairs vacancy costs or really anything that it takes to maintain the property.

Capital gains tax rate of 0 15 or 20 depending on filing status and taxable income. The math is a bit more complex than well want to dive into here but to get a ballpark of your expenses you can enter the cost of your property and other variables into a property depreciation. I am trying to figure out how to fill out form 4797 for the tax year 2013.

Calculate Everything you Need to Know about your Tax and How Tax Affects you. Available online or as an app for iPhone iPad and Android phone or tablets for use anytime anywhere the BMT Tax Depreciation Calculator is an indispensable tool for anyone involved in property investing. Previously the cap was 15.

DepPro Depreciation Professionals property report investment property calculator investing in property tax depreciation property depreciation Melbourne. Your depreciation recapture tax rate will break down like this. Depreciation rules for listed property.

Or MACRS is the primary method of depreciation for federal income tax. FAQ Blog Calculators. You should claim catch-up depreciation on this years return.

- Purchased in 2007 for 240000 Land. Special depreciation rules apply to listed property. Depreciation recapture tax rate of 25.

Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to be your income tax rate with a cap at 25. 190000 - Sold in 2013 for 251900. This calculator performs calculation of depreciation according to the IRS Internal Revenue Service that related to 4562 lines 19 and 20.

My mother also claimed depreciation on the rental property during the years under her ownership. Catch-up depreciation is an adjustment to correct improper depreciation. To show you how a depreciation schedule can save you money Ill be covering what a property depreciation schedule.

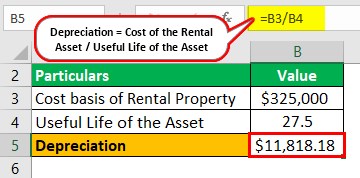

Taxable local interest calculator Taxable Local Interest. Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential real property. You should claim the correct amount of depreciation each tax year.

The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated depreciation the book value at the end of the year and the depreciation method used in calculating. Car accessories car parts car repair car workshop car bodykit car tyre sport rims car mat car stickers car rental car blog lorry rental van rental bus. Calculate Property Depreciation With Property Depreciation Calculator.

This 25 cap was instituted in 2013. Yes you should claim depreciation on rental property. It excludes vehicles that arent likely to be used for personal purposes due to their nature or design like.

Car Sale Roadshows. Retirement savings calculator Retirement Savings. Input details to get depreciation.

If you sell rental or investment property you can avoid capital gains and depreciation recapture taxes by rolling the proceeds of your sale into a similar type of investment within 180 days. Rental property owners use depreciation to deduct the purchase price and improvement costs from your tax returns. Depreciation recapture tax rates.

It was used as a rental property the entire time and was never owner occupied. This depreciation calculator can use either the straight line or declining balance method to calculate depreciation over the useful life or recovery period. Use our medical aid credits calculator to work out how much of your medical spending you can claim back from tax.

We follow a 40-year investment strategy that increases the monthly cash flow for rental income through tax depreciation schedules accepted by the. Also you may have to pay self-employment tax on your rental income using Schedule SE. When you sell a rental property you need to pay tax on the profit or gain that you realize.

Depreciation Wear and Tear deduction on the assets you use for work Wear Tear. This is known as depreciation recapture which is specific to rental properties and the amount previously taken as a depreciation deduction is taxed at a recapture rate of 25. The duplex was purchased in 2007 for 240000 and sold in 2013 for 251900.

FAQ Blog Calculators Students Logbook Contact LOGIN Earn under R500000. Our tool is renowned for its accuracy and provides usable figures and a genuine insight into the potential cash returns you could expect from an investment property. Depreciation is one of the best tax breaks available to property investors but youll need a depreciation schedule in order to claim it.

Taxes rental property investors need to pay. Passenger automobiles and other property used for transportation. The IRS taxes the profit you made selling your rental property 2 different ways.

This MACRS depreciation calculator gives the user the information they need to aid them in making the tax conscious decision. This rental property calculator lets you enter all your. Now on to the slightly more complicated rental yield formula.

That 709 form is not too hard to do by hand in this case.

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Investing Rental Property Calculator Determines Cash Flow Statement Real Estate Investing Rental Property Real Estate Investing Rental Property Management

Renting My House While Living Abroad Us And Expat Taxes

Free Construction Cost Calculator Duo Tax Quantity Surveyors

Depreciation For Rental Property How To Calculate

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

How To Use Rental Property Depreciation To Your Advantage

Rental Property Depreciation Rules Schedule Recapture

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator Irs Publication 946

Free Macrs Depreciation Calculator For Excel

How To Calculate Depreciation On A Rental Property

Depreciation Schedule Formula And Calculator

Rental Property Depreciation Rules Schedule Recapture

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Macrs Depreciation Calculator With Formula Nerd Counter